The share of agricultural products in the total exports from Ukraine grows annually. Over the past 10 years, the volume of major crop exports has increased tenfold. Ukraine, which exports its products to 174 countries, takes leading positions in the world food market. In particular, it is the world leader in the production of sunflower and sunflower oil and in export of sunflower oil.

According to experts, Ukraine owes its agricultural breakthrough in the past decade to several factors. Among them are the adoption of modern technologies in production, processing and storage of products; improvement of efficiency and change of the management system at agriculture companies and so on.

Market participants

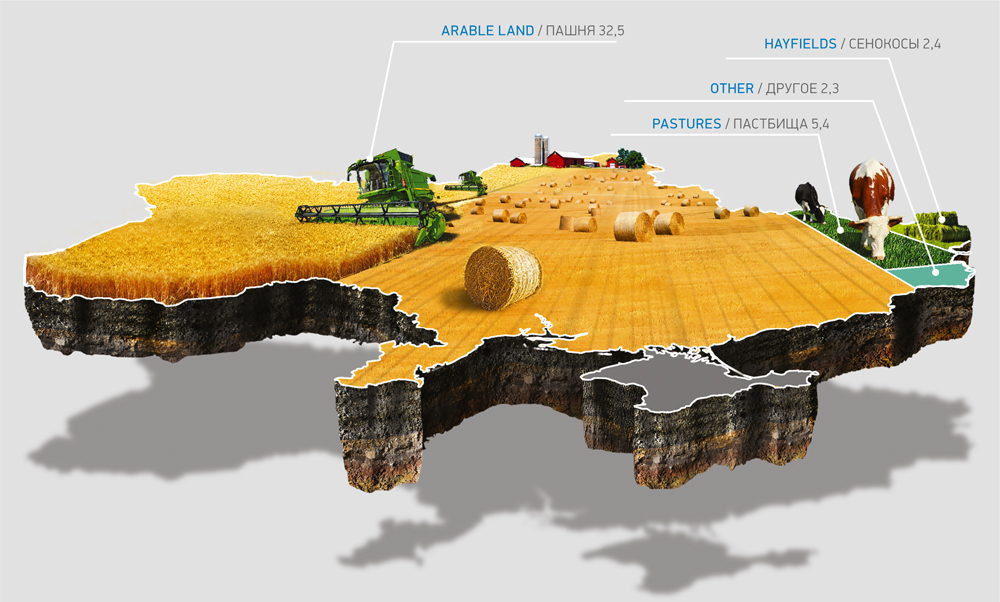

Image: Structure of farmland in Ukraine, million hectares

There are 45,900 agriculture companies in Ukraine, of which 70% are farms. Most agriculture companies are clustered in Kyiv, Odesa, Dnipropetrovsk, Mykolayiv, Kirovograd, Zaporizhzhya and Vinnytsya regions. Ukrainian agrarians are not cramped as 70.8% of Ukraine's territory, or 42.7m hectares, is farmland. There are 150 companies with over 10,000 hectares in use, including 14 agro holdings which cultivate 100,000 hectares and more. Five large companies cultivate 2.3m hectares of Ukrainian black soil, or 7% of the country's arable land. These are UkrLandFarming, KERNEL, Agroprosperis (New Century Holding), Myronivskyy Hliboprodukt (MHP) and Astarta-Kyiv. The annual revenues of these players reach around $5bn. These agro holdings have a higher yield on average than independent agriculture companies (not incorporated into holdings). The EBITDA of the most effective agro holdings reach $500.

The structure of the Ukrainian agrarian market may change with the launch of the land market. At the end of 2017, parliament extended the moratorium on the sale of land by another year for the ninth time. Officials said the "unanimous" decision was taken because the issues of land consolidation, state- and community-owned land (10.5m hectares) had not been settled.

Vladyslav Ostapenko, head of corporate finance and M&A at EY Ukraine, says: "Without lifting the moratorium on the sale of land, we should not expect any truly big investments in the industry. When the land market is here, we may expect, apart from equity capital (meaning business owners' money), the market of bank loans to open and to be able to finance businesses on the security of their main asset, land." Nevertheless, the government plans last year to lift the moratorium stirred the Ukrainian agrarian market. Many investors, Ostapenko continues, started to actively increase the size of their business and buy smaller companies. "This had a strong impact on the rent per leased hectare of farmland in M & A transactions. Whereas two years ago, offers and deals in lucrative areas were based on $300-400 per hectare, in 2017 the price per hectare returned to the pre-crisis level of $1,000 and more," he explains.

Preliminary results for 2017

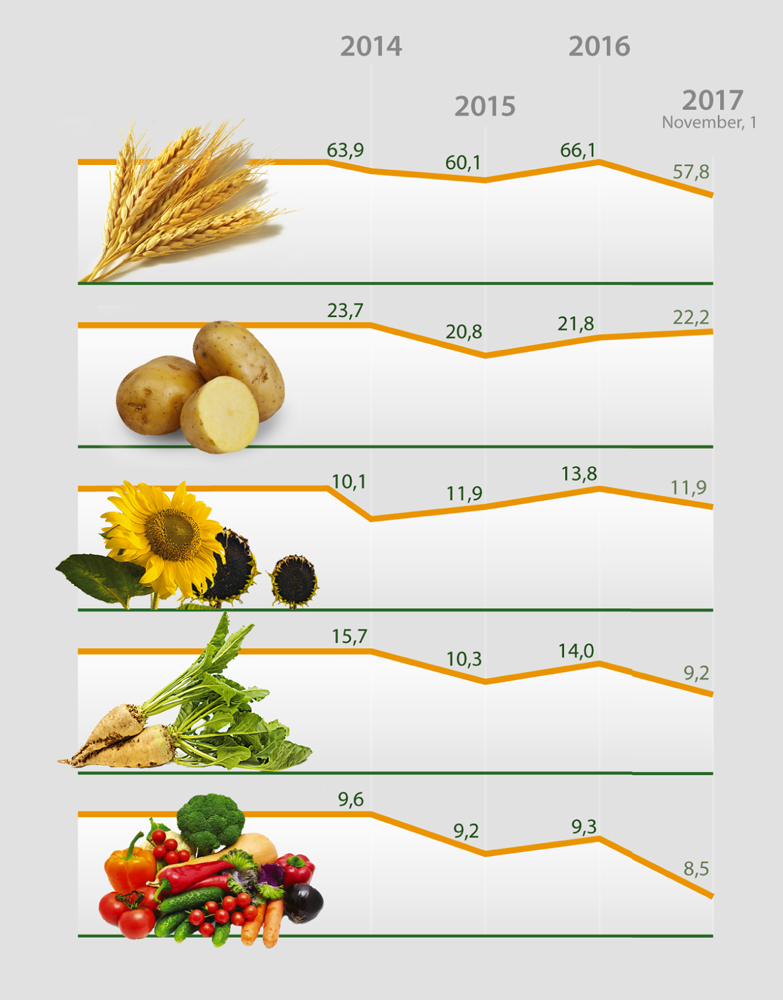

The country produces 2.7 times more crops in monetary terms than livestock. The most popular crops are wheat, corn and barley. In the 2016-2017 marketing year (July to June), the country had a record-high harvest of 66.1m tonnes of grain. Analysts predict 62.5m-63.3m tonnes of grain and pulse crops to be harvested in the 2017-2018 marketing year. Gross harvest of wheat is expected at the level of 26.1m-26.6m tonnes and that of maize at 25.4m-25.6m tonnes. According to agrarians, grain production costs in 2017 increased by 15-30%. The increase was mostly due to a higher price of fertilisers. Also, unfavourable weather conditions caused plant diseases and producers faced extra costs to have crops treated with protection agents.

Image: Crops production in Ukraine, million tonnes

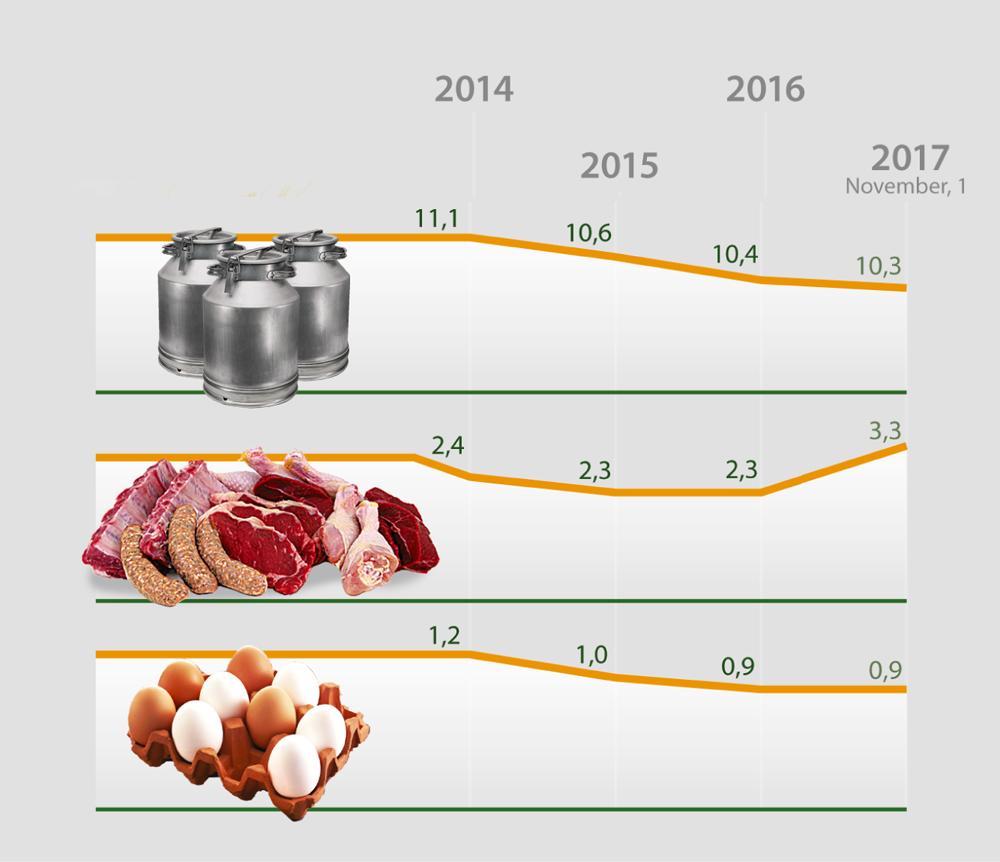

The livestock sector is gradually overcoming negative trends. In January-November 2017, Ukrainian agriculture companies (excluding households) sold 1.83m tonnes of meat of all types of animals for slaughter (in live weight), which is almost on par with 2016. During the same period, farms increased the production of milk and eggs. In January-November 2017, they produced 25m tonnes of milk, or 1.9% more than during the same period of 2016. Egg production was 4% up to 7.7bn in 2017 (over 11 months).

Poultry is the most developed sector of Ukrainian livestock production. Due to a high inflation and the decreased purchasing power of Ukrainians, poultry meat is in great demand in the domestic market because it is relatively cheap. After pork and beef prices went up in 2017, poultry consumption in the home market continued to grow. According to the Union of Poultry Breeders of Ukraine, poultry accounted for 48.8% of meat consumption in the country, pork, 40.5%, and beef, 10.3%.

Higher demand in the domestic market as well active exports last year stimulated an increase in poultry production. In January-November 2017, compared with the same period of 2016, poultry production by agriculture companies increased by 4.7% up to 1.3m tonnes (in live weight).

Image: Livestock production in Ukraine, million tonnes

Unlike poultry, cattle and pigs are in decline. In January-November 2017, the number of cows on industrial farms went 3% down (to 470,000) while milk production, as mentioned above, increased by 1.9%. This happened thanks to an increase in production on large dairy farms.

Pork production in Ukraine is also decreasing. According to the State Statistics Committee of Ukraine, the volume of pig production (in live weight) by agriculture companies shrank by almost 10% down to 484,000 tonnes. One of the main reasons for this was a decrease in the number of pigs due to an outbreak of African swine fever.

In general, analysts predict that the share of poultry in Ukrainian livestock will continue to grow (both thanks to domestic consumption and exports) while beef and pork production will moderately recover.

Financial support promised by the government may become a certain incentive for livestock development in Ukraine. The 2018 state budget provides 4bn hryvnyas for livestock (the entire agribusiness will receive 7.3bn hryvnyas). According to First Deputy Agrarian Policy and Food Minister Maksym Martynyuk, 75% of this amount will be used to reduce the cost of loans for the construction or reconstruction of livestock farms.

Export record

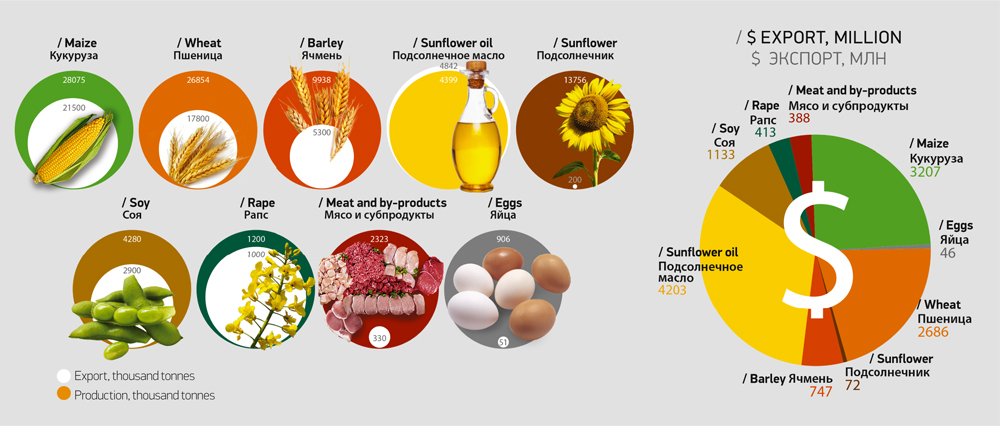

Image: Production and export of certain types of foodstuffs in 2016

Foreign trade in farming produce is one of the drivers of the growth of the Ukrainian agricultural sector. In January-October last year, the exports of Ukrainian agrarian and food products reached $14.7bn. There was a 22.7% increase, or by $2.7bn, compared with the same period of 2016. Agricultural imports were 8% up to $3.6bn.

Given this dynamic and the traditional growth of grain exports during the last months of the year, Ukraine can set a historic record in 2017 by posting $18bn in revenues. By the way, Ukraine reported its highest food exports, $17.9bn, over the years of independence in 2012 when prices for grain and oilseed crops in the world market were high.

According to USDA, grain exports from Ukraine in the 2017-2018 marketing year will reach 42.6m tonnes (43.8m tonnes in the previous marketing year).

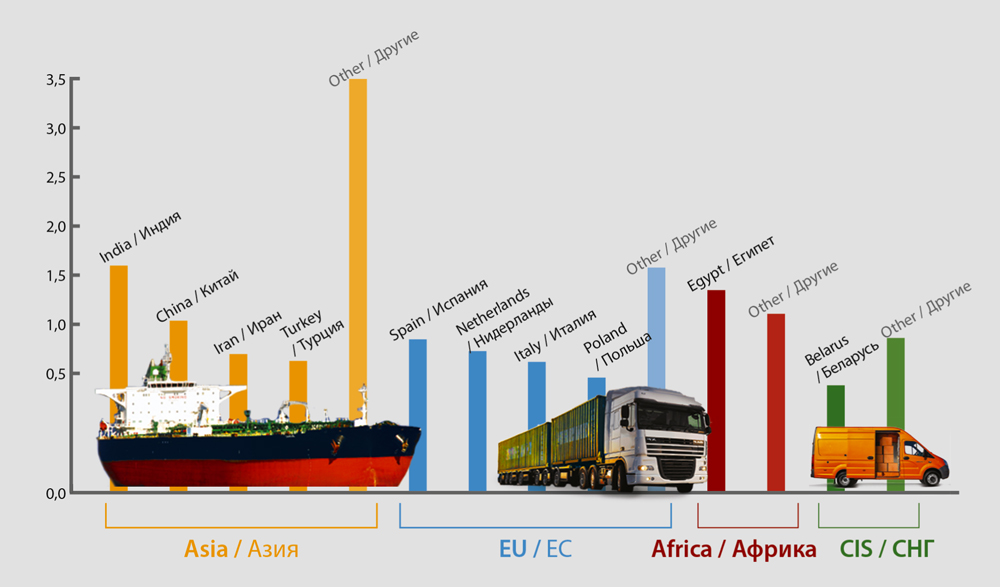

Image: Main importers of Ukrainian farm produce, billion $

Analysts expect no significant changes in the geography of Ukrainian grain exports. Andriy Kupchenko, a grain market analyst at APK-Inform, said, in particular, that this season, Ukraine is exporting more wheat to Indonesia and Egypt. In the Egyptian market, Ukraine may have to give way to Russia which will have a record grain harvest (137m tonnes) this season and increase its export potential by over 30%.

A traditional customer for Ukrainian barley is Saudi Arabia. This season China significantly increased the purchase of this crop from Ukraine too.

As for maize, its main distribution market is the EU. "Ukraine ensures 62% of maize imports to the EU. Iran will be of interest to local maize exporters as well. Last season, this country increased the purchase of Ukrainian maize more than three times, and experts say it will increase maize consumption by another 21% in the 2017-2018 marketing year," he says.

What's in sight?

Despite good achievements in agrarian production, experts say Ukraine's agribusiness has the potential to grow. In particular, if Ukraine uses its land resources and investments in the most efficient manner and optimises agricultural production costs, it can boost its gross grain harvest from the current 60m tonnes to 100m tonnes a year and further strengthen its position in the world market. There is a potential for increasing productivity in both crops and livestock production.

Experts say that, given favourable weather conditions and an increase in crop yield, Ukraine's agrarian exports can reach $20bn in the coming years.

Vladyslav Ostapenko, head of corporate finance and M&A at EY Ukraine, says: "Investments in the Ukrainian agriculture will remain at $2bn in conditions of low activity on the part of foreign investors, which are fewer than two dozen at the moment (active ones are even fewer). The absence of the land market, which would require 10 times bigger investments, is also a factor. The main areas for investment are stocking up on land by buying other agriculture businesses; updating agriculture equipment; building or improving an elevator infrastructure; establishing processing companies which will use local raw stuff to make products or by-products with added value."

Archive 2018-2021

Agrolocomotive of Ukraine: Talking Analytics

The agrarian sector has been the locomotive of economic growth in Ukraine in recent years. Agriculture generates about 12% of the country's GDP, providing jobs for millions of Ukrainians. Let's see what experts have to say about the current rates and agrarian sector future.