It is time to receive is what banks say about the financing of agricultural enterprises. Banks have long cooperated with large enterprises in Ukraine, however the year of 2017 brought a lot of positive news for small and medium-sized agribusinesses too. In particular, the number of credit and leasing programmes is growing while rates are decreasing. The emergence of new interesting proposals for the financing of farmers is very important to the domestic agrarian market.

After all, the largest agricultural producers, such as Nibulon, Kernel, Myronivskyy Hliboprodukt (MHP) and Astarta, have long been using money borrowed from the European Bank for Reconstruction and Development (EBRD) and largest foreign banks. Their loans come in tens and hundreds of millions of dollars. For example, in July 2017, Nibulon and the EBRD concluded a $90m loan agreement to restore the river transport infrastructure. The company expected an additional $40m from the EBRD in December 2017 to invest in the expansion of grain logistics. In December 2017, the EBRD issued a 25m-euro loan to MHP for the construction of a biogas plant. In January 2017, Kernel raised $500m by placing five-year eurobonds on the Irish Stock Exchange.

In October 2017, a syndicate of European banks allocated a $200m loan to the largest sunflower oil producer. Such borrowings (both in terms of rates and amounts) are not available to small and medium-sized agricultural companies. There are credit programmes offered by domestic banks for them. So, what do they offer?

Credit for year and a half

Usually, banks offer agribusinesses credit lines to replenish their current assets. Such loans can be issued for 12-18 months (24 months at most). Lines cane be renewable or non-renewable, and companies can use borrowed funds based on their own needs. For example, they can buy equipment, premises, seeds or fertilisers. The amount of a credit line depends on several factors, the key ones being the agricultural company's average annual operation costs and the estimated value of collateral which the company uses to secure the bank's loan.

"Financing is allocated in both the hryvnya and foreign currency with a credit limit of up to 50% of the agrocompany's average annual operation costs. Loans can be secured by immovable property, vehicles, equipment, property rights to bank deposits, private property of the company's founders. Future harvest can be used as an additional collateral," the director of the SME department at Pivdennyi Bank, Nina Taranenko, explains.

Banks reduced the rates of loans to replenish current assets by 1.5-4.4 percentage points in 2017. By the end of December, interest rates on such bank programmes were in the range of 16-22% per annum (in the hryvnya).

Borrowers must pledge some assets to be issued with a loan. Collateral may include immovable property, vehicles, machinery and rights to bank deposits.

For a bank, it is extremely important to assess a potential borrower's business in terms of its ability to pay off the loan. Therefore, not only the collateral matters but also the financial standing of the company and its credit portfolio (debts to counterparties and other banks). Applications from companies with bad credit history will be rejected. That is, if the company has not paid off an earlier loan, is involved in litigation with banks and refuses to transfer its collateral to the bank (or undergoing a bankruptcy procedure). Among their standard requirements, some banks may ask future borrowers to specify how much land is available to them, for example no less than 500 hectares. Experience is also important. Applications by novice borrowers, who have been on the market for less than three years, are likely to be rejected.

Machinery for five years

Banks have special credit programmes for those seeking to buy agricultural machinery and special vehicles. Many banks, such as OTP Bank, Oschadbank, Privat, ProCredit Bank, Ukreximbank, Credit Agricole Bank, Ukrgazbank, Pivdennyi Bank, Kredobank and others, are developing these solutions. As a rule, banks offer standard programmes for the purchase of agricultural machinery with rates ranging from 17% to 23% per annum (in the hryvnya). Equipment loans are available for five years while the borrower's down payment must be at least 20-30%. There is an origination fee reaching 1-2% of the borrowed amount.

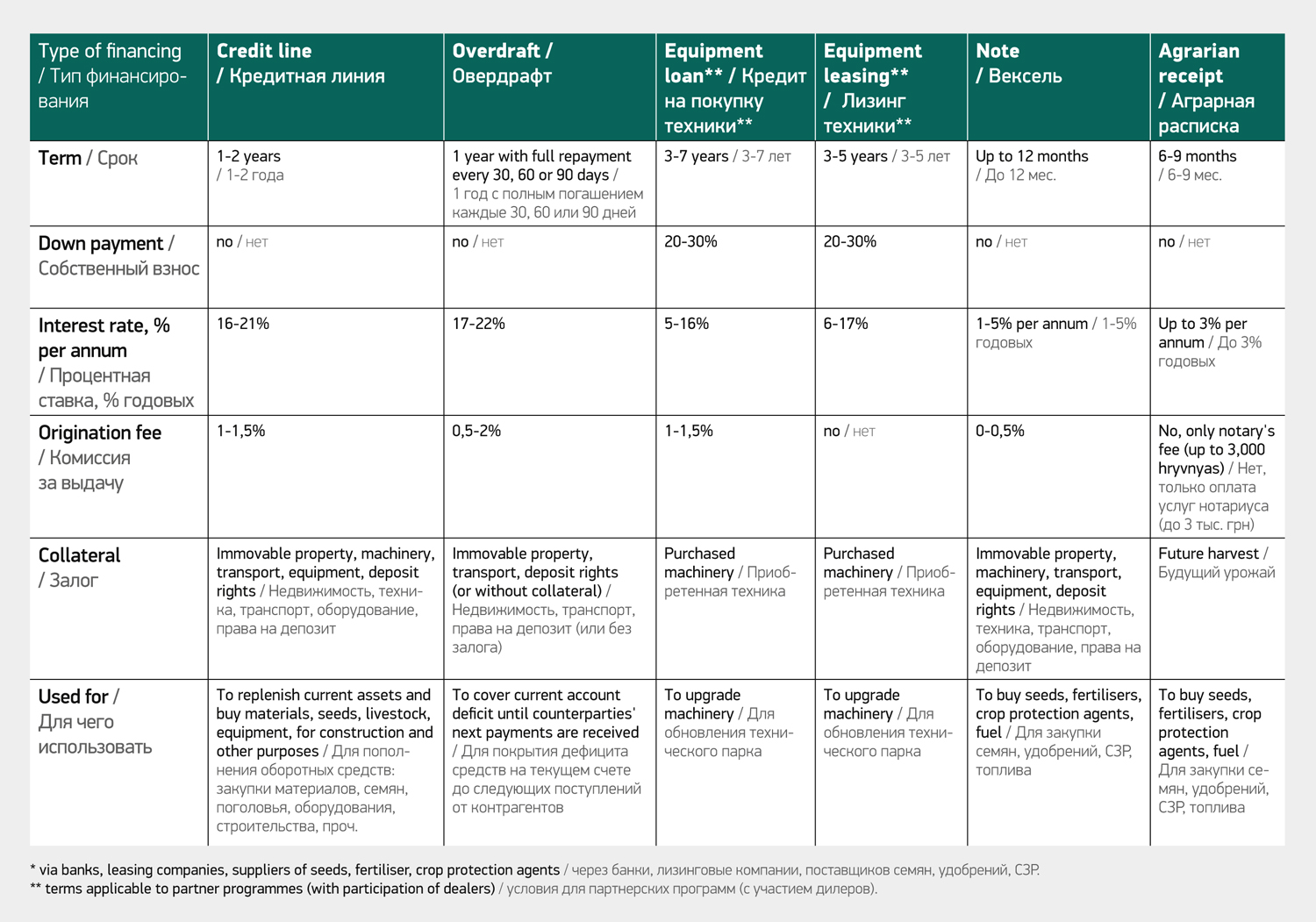

Image: Main ways of financing agribusiness (via banks, leasing companies, suppliers of seeds, fertiliser, crop protection agents)

Partner programmes may offer better terms. Banks offer such loans with special terms as part of their cooperation with certain dealers of equipment and vehicles. Such loans are issued at 5-16% per annum. Sometimes these programmes have no one-off fee while in some cases loans can be issued against zero down payment.

Every bank has its own set of partners whose equipment is offered for purchase on credit on special terms. For example, Raiffeisen Bank Aval issues loans to those planning to buy Case, New Holland, John Deere, Lemken, Gaspardo, Changling, Kuhn, Massey Ferguson and other brands' products. Oschadbank finances the purchase on credit of equipment manufactured by Challenger, Kockerling, John Deere, Lemken, Fantini, Massey Ferguson, Geringhoff, Bicchi, Apache, Iveco, Kuhn, Maschio Gaspardo, Agrisem and others.

Credit terms depend on a particular brand. For example, Raiffeisen Aval offers Fendt products on credit, subject to a 50% down payment by a borrower, for 12 months at 9% per annum (in the hryvnya). ProCredit Bank has a joint programme with Amako and offers its products for purchase on credit. If the loan is issued for 12 months and a borrower pays 50% of the cost, no down payment may be required.

Not only banks but leasing companies have partner programmes with dealers. In general, the leasing of agricultural machinery in Ukraine is being promoted by OTP Leasing, Eximleasing and ULF Finance. Down payments here reach 15-30% and leasing contracts are concluded for four to five years. By the way, leasing companies' clients can receive financing in the dollar or euro at 1.5-5% per annum. Banks also offer foreign currency loans but this option is only available to companies which officially receive foreign currency earnings (that is, exporters). If leasing agreements are in the hryvnya, the rates range from 8% to 18% per annum.

Cheaper than a loan

If agricultural companies need money to buy crop protection agents, fertilisers or fuel, banks offer them promissory notes. They are avalised by Oschadbank, Raiffeisen Bank Aval, First Ukrainian International Bank, Alfa Bank, Kredobank, Ukreximbank and Credit Agricole Bank. Essentially, this solution allows agricultural companies that buy crop protection agents or seeds (or other goods) to defer payments to the supplier. "This programme is for agricultural producers. A bank avalises (guarantees payment) a promissory note which the agricultural producer presents to the distributor of seeds and crop protection agents. For amounts of up to 2m hryvnyas, OTP Bank avalises a promissory note without collateral. If the amount is from 2m to 8m hryvnyas, the bank will avalise a promissory note only if it is secured by an agrarian receipt or future harvest without any additional hard pledges (immovable property or machinery)," says Ivan Yerko, head of the OTP Agro-Factory department at OTP Bank.

Often payments under promissory notes are deferred by up to nine months. Avalisation costs around 1-5% per annum. However, most often banks require borrowers to pledge premises or machinery (vehicles). Recently, however, increasingly more banks agree to avalise promissory notes secured by future harvest or agrarian receipts written by a borrower in favour of the supplier of fertilisers or seeds.

Author: Nataliya Boguta