Both small farms and large holdings cannot avoid weather risks, which cause many problems leading to financial losses due to the damage of crops, thus biting into companies' finances. "A farmer I know had this story when he had very good young wheat crops – big, juicy shoots. He could not be happier, expecting a big yield. Suddenly, during the summer, a hurricane and shower rains laid his crops flat. The battered crops could not get up and the yield was lost," I heard at an agricultural company in Dnipropetrovsk Region. Regretfully, the unfortunate farmer's fields were not insured. The company incurred losses as a result.

Certainly, agriculture companies cannot escape unforeseen weather catastrophes. But they can hedge against financial risks by insuring their fields. Overall, agro insurance in Ukraine cannot boast a good pace of development. However, the recent data is encouraging. The International Financial Corporation (IFC) said in its 2017 insurance market review, in particular, that agro insurance premiums collected last year increased by 30%. The period in question is certainly the underwriting year (which includes two agricultural seasons – insurance of winter field crops planted in 2016 for the wintering period and insurance in the spring-summer 2017).

According to the IFC, in the 2017 underwriting year, insurance companies signed a total of 957 insurance contracts for crops and perennials worth 5.913bn hryvnyas (or 222.8m dollars). There are 12 big insurers in the market which offer agro insurance services. Some of the leading companies are INGO Ukraine, Brokbusiness, Universalna, ASKA, PZU Ukraine, Krayina, Zdorovo and TAS.

Protection

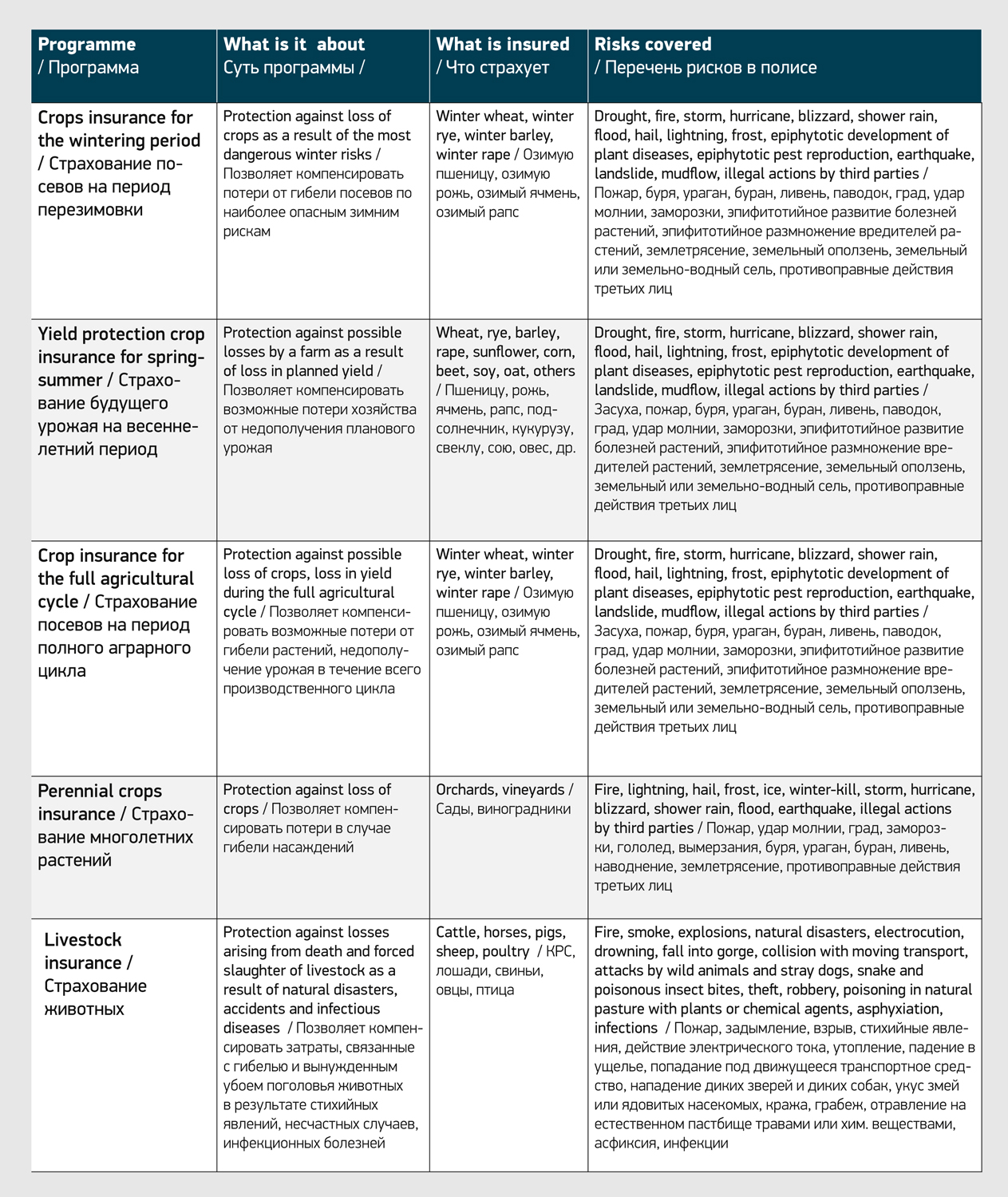

As a rule, there are four key programmes of farmland insurance (see infographics). Separately, it is worth mentioning a livestock insurance programme for poultry and cattle. But this type of insurance is uncommon. For example, whereas in 2017 insurance companies signed 957 contracts on crops insurance with agrarians, only 23 livestock insurance contracts were concluded with animal farms.

So, which agro insurance programmes are available today? "Comprehensive crops insurance against their complete loss in the winter as well as crops insurance against loss or damage by hail or fire continue to enjoy a top popularity. As yield losses can be big, yield protection crop insurance is also in demand," says the head of corporate insurance at INGO Ukraine, Sergiy Kryvosheyev.

A typical selection of insured risks covers key incidents which may negatively affect the condition of crops and yield. Basic incidents included in an insurance contract are drought, hail, fire, frost, ice crust, winterkill, mudflow, hurricane, shower rain, flood, plant diseases, and earthquake. In addition, an insurance usually covers "illegal actions by third parties". In this case, a farmer will be paid if hooligans or rivals set his or her field on fire, for instance.

Image: Top five agricultural insurance programmes

Agriculture companies looking for insurance should take into account that the term of an insurance contract is usually limited to a certain production stage. For example, wintering insurance is effective from the moment vegetation resumes to the harvesting campaign. For spring crops, a contract commences with the first shoots and ends with harvesting.

Most agro insurance programmes have an unconditional franchise of 10-70%. When an insured event occurs, an insurance company pays the refund minus a franchise.

Insurance tariffs for agriculture companies in 2017 equalled 2.8-4.8% of the estimated cost of crops (future yield) on average. The tariff is influenced by insurance coverage, franchise, location of fields, and type of crops. "The cost of insurance is the ratio of risk to insurance premium received by the underwriter. When you calculate the total cost of insurance, it may seem high. But if you spread it per unit of insured area, it will turn out that wintering insurance for winter wheat, barley and rye will cost 120-150 hryvnyas per hectare and for winter rape 220-280 hryvnyas per hectare," Kryvosheyev explained.

There are area-yield index insurance programmes in the market too. An indemnity under this type of insurance depends on the guaranteed average yield in the area in the course of 15 years. Usually, the insured yield is set at 70% to 25% of the average yield for the area. Crops eligible for such insurance are winter wheat, winter rye, spring barley, sunflower, corn and sugar beet. An indemnity is paid if the realized average yield for the area is less than the insured yield for any reason.

Claim what is due

The first step towards protecting your fields is to prepare documents required for the conclusion of a contract. Usually, an insurance company will require a written letter of intent from an agricultural company planning to sign a contract, a standard crops inspection certificate, a certificate of average yield for the past three to five years, a map or a standard description of the arable land or area under crops, and a crop chart. All of the mentioned documents are mandatory.

By signing a contract, an agriculture company effectively obliges to regularly monitor the condition of crops and report any negative factors to the underwriter immediately, that is within three to five days after the event. For example, the main risk to winter crops during the autumn-winter season is a drop of temperature below the critical level. Therefore, agrarians must inform the insurance company about adverse weather conditions that occurred during the wintering and may have damaged crops. Otherwise, in the event of the loss of crops, an indemnity will not be paid out (because the insurer was not informed on time).

"After the insurer is notified about the occurrence of an insured event, its representative visits a farm to inspect the damaged crops. The insurance company's representative counts the number of plants on the damaged field or its part per unit of area. An inspection report describing the condition of crops is drawn by filling out a special standard form. Based on the inspection report, the insurer prepares a claim report in which it indicates the amount of a future indemnity," Kryvosheyev explains the claim procedure for an agriculture company.

To claim its indemnity, an agriculture company must file a package of documents with an insurance company, which includes a written application, a certificate from the Hydrometeorological Centre about weather conditions in the area under crops, invoices and write-off certificates for seeds, fuel and mineral fertilisers. By the way, if the loss happened as a result of illegal actions by third parties, an agriculture company must provide the insurance company with a report from the local office of the Interior Ministry, confirming the occurrence (reasons, circumstances) of the insured event.

It is important to remember that an insurance company has the right to refuse to indemnify those who fail to report an insured event on time. Another reason for refusal can be a blatant violation of agrotechnical regulations on the cultivation of insured crops. Also, if some illegal actions were committed and an agriculture company received was reimbursed by the perpetrators (for example, based on a court decision), an insurance company will also refuse to pay an indemnity.

Author: Nataliya Boguta

Archive 2018-2021

Hedging Risks in Ukrainian Agro Insurance

Ukraine's agro insurance market has turned 17 already. So, who should you contact if you want to have your fields insured? Destinations helps to find out.